In the rapidly expanding world of online payment and financial services, new platforms frequently emerge promising convenience and fast transactions. However, not all of these platforms operate with integrity or transparency. Paychs.com is one such service that has recently attracted negative attention due to numerous concerns raised by users and industry watchers. This review examines why Paychs.com raises serious doubts and why potential users should exercise extreme caution.

What is Paychs.com?

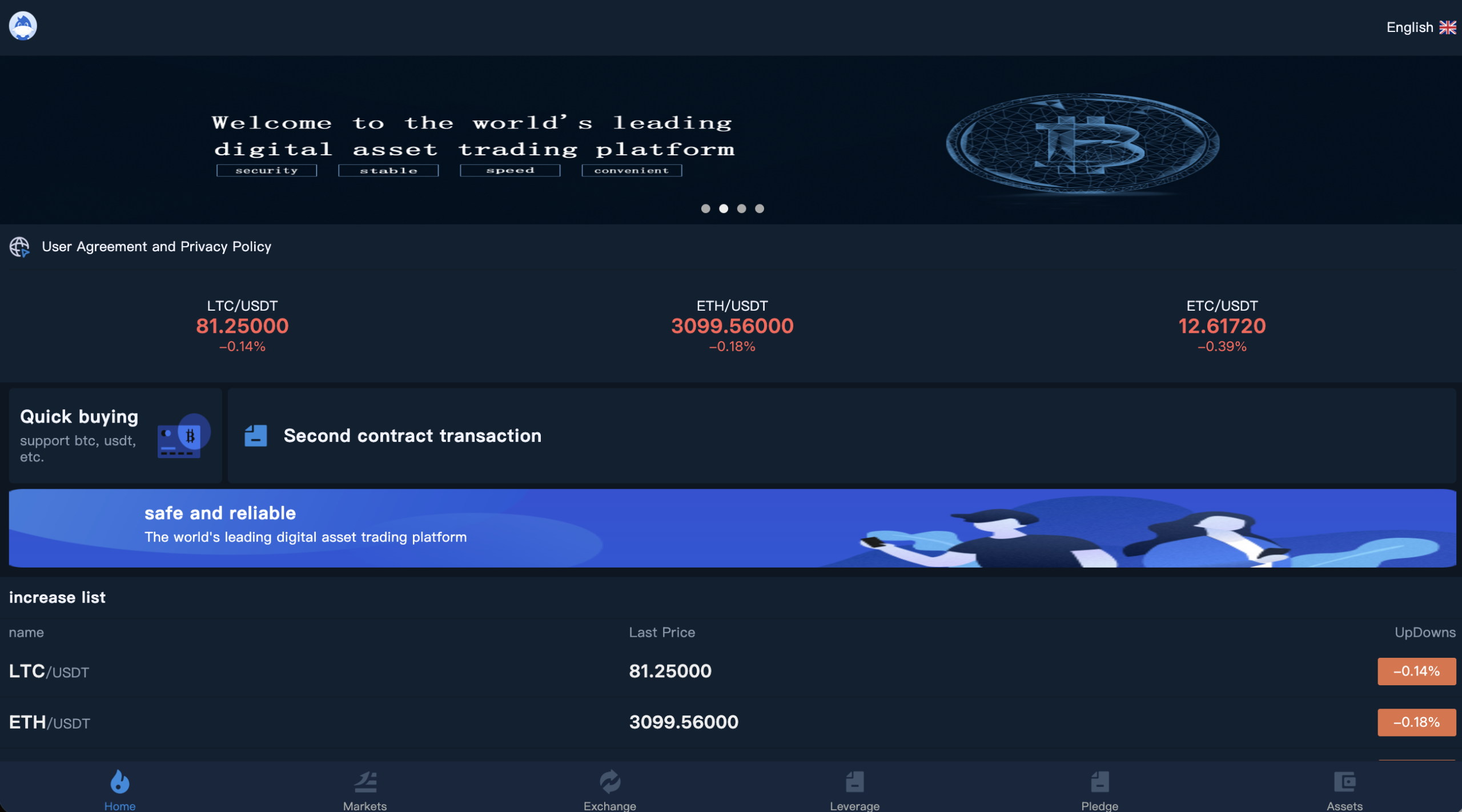

Paychs.com markets itself as a digital payment platform designed to facilitate quick and easy money transfers, bill payments, and online transactions. It claims to offer a seamless experience with competitive fees and broad accessibility. On the surface, this sounds appealing, especially for users seeking alternatives to traditional banking systems. Yet, a deeper look reveals troubling aspects that undermine these promises.Key Concerns and Warning Signs

1. Lack of Clear Licensing and Regulation One of the fundamental indicators of a trustworthy payment service is proper licensing from financial authorities. Paychs.com does not provide verifiable information about any regulatory approvals or licenses. This absence of oversight means there is no guarantee that the platform adheres to legal standards or safeguards users’ funds and data. 2. Incomplete Company Information Paychs.com offers minimal details about its ownership, physical location, or leadership team. Legitimate financial services typically disclose such information to build credibility and accountability. The platform’s lack of transparency makes it difficult to verify who is behind it or hold anyone responsible if issues arise. 3. Reports of Transaction Failures and Delays Numerous users have reported problems with processing transactions through Paychs.com. Complaints include delayed transfers, unexplained payment failures, and funds disappearing from accounts without confirmation. Such operational inconsistencies suggest unreliable service and poor management. 4. Poor Customer Support When users encounter issues, customer support should provide timely and helpful assistance. Unfortunately, Paychs.com’s support channels are reportedly unresponsive or provide vague answers that fail to resolve problems. This lack of support exacerbates user frustration and distrust. 5. Security Concerns A reliable payment platform must prioritize security measures to protect sensitive financial and personal information. Paychs.com does not clearly communicate the security protocols it employs, such as encryption or fraud protection. This omission raises concerns about data safety and potential exposure to cyber threats.How Paychs.com’s Risky Pattern Unfolds

Based on user experiences and platform behavior, the following pattern emerges:- Attractive Marketing: Paychs.com promotes itself as a fast and easy payment solution.

- User Onboarding: New users sign up and deposit funds or link bank accounts.

- Transaction Issues: Users experience delays, failures, or missing funds during transactions.

- Support Silence: Attempts to get help from customer service go unanswered or are unhelpful.

- User Loss: Frustrated users find themselves unable to recover lost money or resolve issues.

Why You Should Think Twice Before Using Paychs.com

Using Paychs.com involves significant risks that could lead to financial and personal losses. Here’s why caution is necessary:- Unprotected Funds: Without regulatory backing, your money may not be safe or recoverable.

- Data Vulnerability: Insufficient security measures put your personal and financial information at risk.

- Unreliable Transactions: Payment failures and delays can disrupt your financial activities.

- Lack of Accountability: The platform’s opaque operations make it difficult to seek redress.

Safer Alternatives and Best Practices

If you need a reliable digital payment service, consider these tips:- Choose Regulated Providers: Opt for platforms licensed by recognized financial authorities.

- Check User Reviews: Research feedback from other users to gauge service reliability.

- Verify Security Features: Ensure the platform uses strong encryption and fraud protection.

- Test with Small Transactions: Start with minimal amounts to assess the platform’s performance.

- Use Established Payment Systems: When possible, rely on well-known services with proven track records.