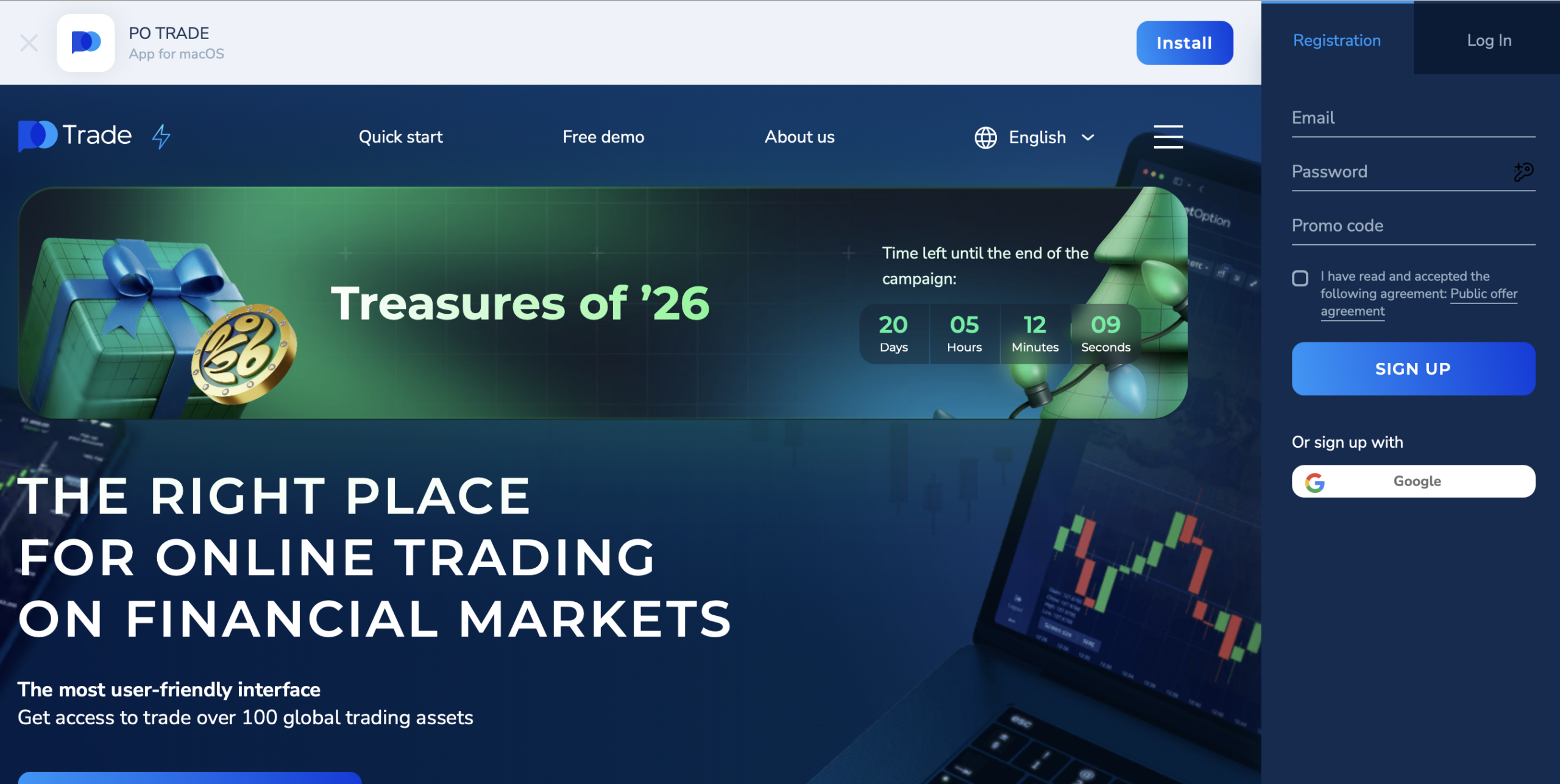

This Po.life scam review explains why this platform is dangerous, how it operates, and why you should avoid depositing any money. Po.life (also known as PO TRADE) appears at first glance to be a modern trading app. It promotes fast payouts, easy trading tools, and a simple interface aimed at beginners. However, behind the marketing, there are serious warning signs.

If you are thinking about using Po.life, read this full Po.life scam review before you decide. The risks are simply too high.

What Is Po.life (PO TRADE)?

Po.life presents itself as an online trading platform offering:- Binary options and other speculative products

- Low minimum deposits

- Fast and easy withdrawals

- A user‑friendly app and web interface

- Tournaments, bonuses, and social trading features

Po.life and the Problem of Regulation

One of the most important sections in any Po.life scam review is the question of regulation. Legitimate brokers are supervised by recognized financial authorities. These authorities create rules for:- Client fund safety

- Clear risk disclosures

- Fair dealing and order execution

- Handling complaints and disputes

Vague or Misleading Regulatory Status

Po.life and related entities such as PO TRADE LTD often provide only vague or confusing information about regulation. They may:- Refer to obscure or non‑credible regulators

- Fail to provide clear license numbers

- Avoid direct claims that can be checked in official registers

Unclear Company Details

A trustworthy financial firm clearly lists:- Full legal name

- Registered address

- Country of incorporation

- License and registration numbers

Negative Attention from Watchdogs

Publicly available warnings, negative classifications by watchdogs, and frequent complaints from users are all serious signs. When several independent sources highlight the same problems, the risk level is high.How Platforms Like Po.life Typically Operate

To understand this Po.life scam review in context, it helps to see the common pattern used by high‑risk platforms.1. Aggressive Marketing and Fake Social Proof

First, there is heavy promotion designed to attract beginners:- Overly positive “reviews” and vague testimonials

- Claims of millions of satisfied users

- Promises of quick income and “easy” trading

2. Easy to Deposit, Hard to Withdraw

Next, the money flow is usually one‑way:- Deposits are simple and fast, often through cards, e‑wallets, or crypto

- Withdrawals can become slow, blocked, or “under review”

- Extra document requests

- Hidden conditions

- Demands to trade more or deposit more before withdrawing

3. Manipulated Trading Conditions

Because unregulated platforms run everything internally, they can:- Control prices and charts

- Introduce slippage that hurts the trader

- Freeze the app at critical moments

4. Psychological Pressure to Add Funds

Finally, many users report pressure tactics:- Messages from “account managers”

- Offers of “VIP” conditions for larger deposits

- Encouragement to recover losses by adding more money

Specific Warning Signs Around Po.life

A focused Po.life scam review has to highlight several specific red flags:- Binary options focus: Binary options are extremely high risk and have been banned or restricted in many countries because of abuse and fraud.

- Dubious legal structure: The platform references entities like PO TRADE LTD, but the details are unclear and hard to confirm.

- Poor transparency: Contact details, corporate information, and legal disclosures are incomplete or not easy to verify.

- Regulatory concerns: The platform and related entities have been criticized by regulators and independent reviewers.

Why You Should Stay Away from Po.life

The main conclusion of this Po.life scam review is simple: you should avoid this platform entirely. There are several strong reasons for this.Almost No Real Protection

If something goes wrong on a platform like Po.life, you are unlikely to benefit from:- Official complaints procedures

- Investor compensation schemes

- Strict conduct and capital rules

The Odds Are Against You

Binary options and similar products are usually a zero‑sum or negative‑sum game. When the platform itself:- Controls prices

- Sets payout levels

- Acts as your direct counterparty

Too Many Independent Red Flags

When user complaints, watchdog warnings, and the platform’s own behavior all point in the same direction, the risk becomes unacceptable. In this case, the safest move is simply not to engage.How to Avoid Platforms Like Po.life

To close this Po.life scam review, here are concrete steps to protect yourself from similar platforms.- Check Regulation in Official Registers Find the company’s legal name and search it directly on the website of a well‑known financial regulator. If it does not appear, or details do not match, walk away.

- Look for Warnings by Authorities Many regulators publish public warnings about unlicensed platforms. If the company or its website is listed, treat that as a clear stop sign.

- Be Careful with Binary Options Products that promise fast, high returns with simple “up or down” bets are extremely risky. If a platform pushes these products to beginners, it is not acting in your best interest.

- Test With Small Amounts Only Never deposit more than you can afford to lose. If you do try a new platform, start with a tiny amount and attempt a withdrawal quickly. Any delay or excuse is a warning.

- Value Transparency Over Hype Real brokers emphasize regulation, risk warnings, and clear terms. Scam‑like platforms emphasize bonuses, contests, and emotional marketing.